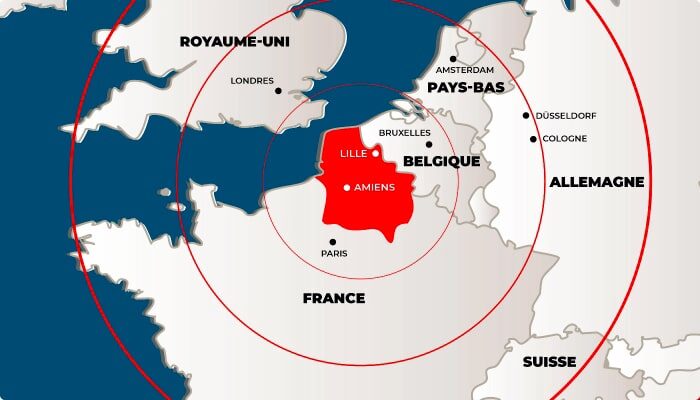

- Foreign companies in all sectors looking to expand in Hauts-de-France

- French companies with no site in Hauts-de-France

- Hauts-de-France companies with a succession plan

- Foreign-owned companies in Hauts-de-France with a development project

- French or international self-employed entrepreneurs

- French companies wishing to export

- International companies seeking distribution networks only

280 m²

280 m²

![[TEMPLATE] How business location specifications can make or break your new venture](https://www.nordfranceinvest.com/wp-content/uploads/2024/01/mockup-cdc-site-ideal-ouvert-bureau-fr-aspect-ratio-443-290.png)