Far-reaching strategy to invest in France

Present in over 30 countries worldwide, GFG Alliance plans to invest in France as part of a larger campaign to expand into Europe.

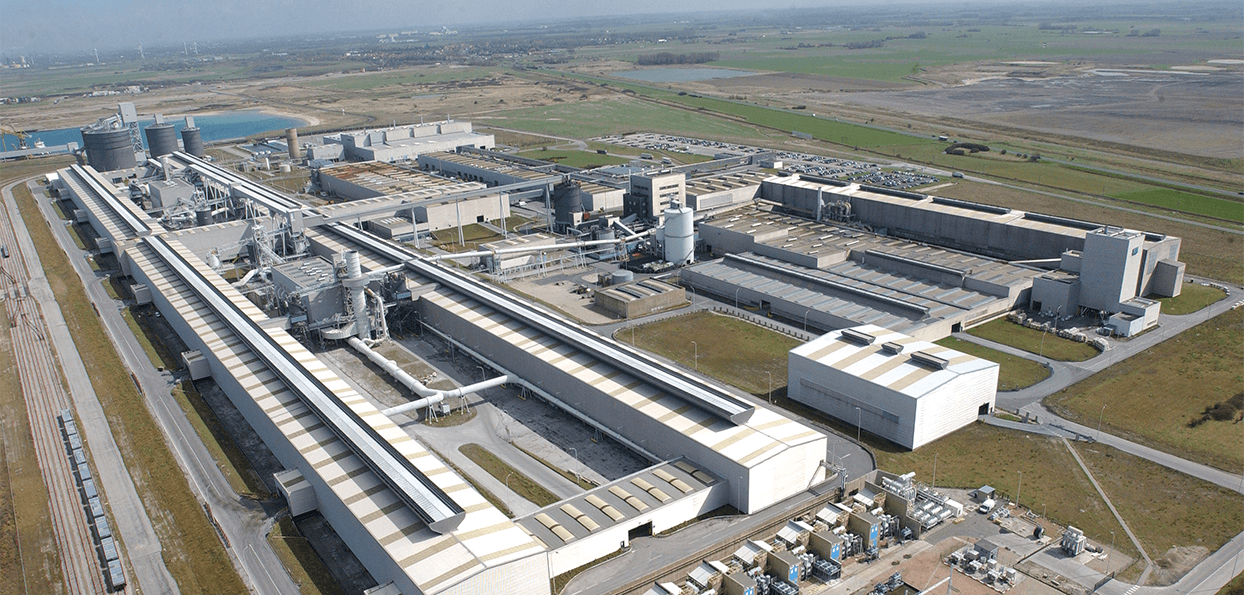

The British group has thus announced plans to invest a total of €2 billion in France, including €417 million ($500 million) in Hauts-de-France to acquire Rio Tinto’s Aluminium Dunkerque, the largest aluminum producer in Europe. Spearheading the acquisition is Liberty House, an industrial and metals business that is part of GFG Alliance. The deal could be finalized in the second half of 2018.

The UK group aims to use this massive investment to position France as a global hub for its operations in the aluminum, steel and automotive sectors.

Acquire, modernize, expand

The proposed €417 million investment includes acquiring the Dunkerque Aluminium site, then modernizing and expanding operations.

GFG Alliance plans to grow its activities downstream from the plant by creating a new auto parts manufacturing site, thus staying out ahead of demand for aluminum in the automobile sector. The new site’s products will be “very high-tech and meet the highest quality standards,” says Sanjeev Gupta, the company’s CEO.

In the long term, GFG Alliance hopes this new investment will create thousands of new jobs (up from the current workforce of 570) and raise production capacity from 270,000 metric tons of aluminum to 280,000.

GFG Alliance

An international grouping of businesses founded by the British Gupta family, GFG Alliance does business in over 30 countries worldwide. It is active in sectors that include energy generation, metals and engineering, natural resources and financial services. With sales of $10 billion, it employs a workforce of 12,000.

Sources: 20 minutes, L’usine nouvelle, Ouest France