Strategically located at the crossroads of Europe

Hauts-de-France offers an outstanding location in the heart of a massive market with 83 million consumers. And we’re within easy reach of three major European capitals—Paris, London and Brussels.

Because we’re at the crossroads of Europe, Hauts-de-France is also a major player in international trade. In fact, we’re the fifth-largest export region and the second-largest import region in France, thanks to our competitive infrastructures, from maritime facilities to rail to road.

🔎 Find out how to optimize your flows with the Hauts-de-France.

Tightly-woven, high-quality ecosystem

Hauts-de-France is home to 550 automotive equipment manufacturers and subcontractors—a business ecosystem with globally recognized know-how that will help make your investment a success.

The region and its business community also encourage workers to acquire new skills, with special emphasis on training.

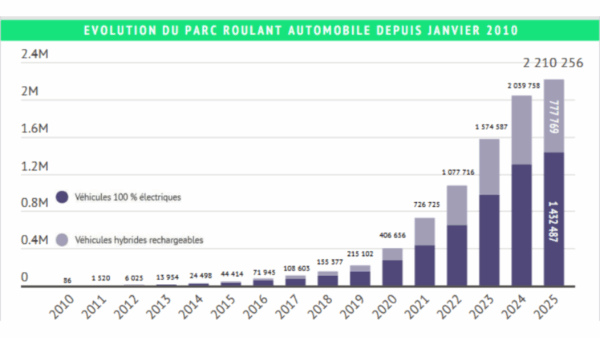

In 2013 the industry launched a training center for the rail, automotive and ecomobility industries (Campus ferroviaire, industries automobiles et éco-mobilité), reflecting our commitment to meeting the challenges of tomorrow—and especially the need to convert our automotive fleet to electric power.

Industry insights

Jérôme Bodelle, CEO of CRITT M2A

CRITT M2A is an independent research center in Bruay-La-Buissière, southwest of Lille. We provide R&D testing services to the auto industry in four key areas: powertrains, turbochargers, acoustics and vibration (NVH), and—since 2014—electric vehicle technology.

Our work on EVs includes testing of the entire electric powertrain: cells, modules and electric batteries.

We work with automakers, equipment manufacturers and consulting firms, and we tailor our testing services to each client’s needs, focusing on charging, for example or battery durability.

Clients work with us to:

- pool skills and resources to move the automotive industry forward in a high-demand market segment

- anticipate and meet critical auto industry needs

- develop solutions that benefit the industry in Hauts-de-France and across Europe

In my view, France’s key advantages for the vehicle market are the low cost of electricity (25%-50% less than in Germany, for example) and our tightly-woven ecosystem of automotive SMEs.

That said, French automotive culture is focused largely on heat engines, so we need to invest in training and the energy transition to close the gap with Asia and other competitors.

Our ecosystem—and particularly our pool of R&D experts—plays an important role even though automaker have adopted very different strategies, with some investing in internal R&D and others preferring to outsource.

CRITT M2A offers a comprehensive vision and experience acquired from a wide range of projects. We harness these assets for our clients, working with them to design effective solutions on fairly tight timelines.

The rollout of electric charging infrastructure.

The Hauts-de-France Regional Council has made electric mobility one of its key priorities.

The Hauts-de-France Regional Council has made electric mobility a priority, investing massively to support sustainability projects in the region and a plan to develop electric mobility.

Hauts-de-France is also running a charging station deployment pilot, working with partners in the French State and at Ademe, the French Environment and Energy Management Agency.

Two companies specializing in charging solutions already have a presence in our region: DBT Group in Brebières and Indelec Mobility in Douai.