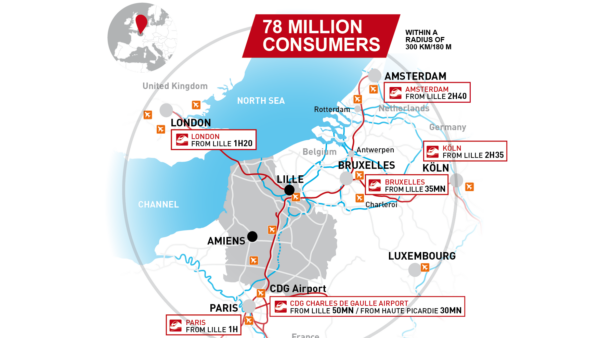

- Foreign companies in all sectors looking to expand in Hauts-de-France

- French companies with no site in Hauts-de-France

- Hauts-de-France companies with a succession plan

- Foreign-owned companies in Hauts-de-France with a development project

- French or international self-employed entrepreneurs

- French companies wishing to export

- International companies seeking distribution networks only

3400 m²

3400 m²